Useful! Probability Weighted Discounted Cash Flow

Cash flow to be received from the investment in each future period over the life of the investment. Equity-settled arrangements have more complex valuation aspects than cash-settled arrangements.

Discounted Cash Flow Modeling Vose Software

The cash flow is certain.

Probability weighted discounted cash flow. DCF Step 1 Build a forecast. The resulting EL calculation can be considered a weighted distribution of economic scenarios. Are entities more likely to use a probability weighted cash flow approach in.

Do so to describe the expected value the probability-weighted average. FVLCD discounted cash flow models incorporate managements budgets or forecasts and market inputs such as inflation GDP growth rates foreign exchange rates and market prices where relevant. On average this forecast typically goes out about 5 years.

In other words if there is a 30 chance that a firm will not survive the next year the expected cash flow should reflect both this probability and the resulting cash flow. IFRS 3 Fair value of contingent consideration. Asset D has a fixed contractual cash flow of 60000 due at the end of six years.

Discounted cash flow calculations and probabilities are theoretical tools that rarely have direct application in a value investors life. The expected cash flow is 60000. A function of the discount rate.

A 90 percent probability that the cash flow will be 10 and a 10 percent probability that the cash flow will be 1000. Using a probability-weighted discounted cash flow model based on the likelihood of achievement of the benchmarks we estimated the remaining fair value of the contingent earn-out consideration to be 05 million. In responding to a recent Exposure Draft one respondent offered the following observation.

The cash flows are first discounted for each state at a rate higher than the risk-free rate but lower than the rate used in a pure rate adjustment model after which a probability weighted single economic value is found for the scenarios. I the fair value of such Notes ii the maximum amount that can be drawn under the respective credit facilities iii the recourse features of such drawings and iv the discount rate relating to National Bank. CU225 CU900 25 Expected cash flow.

The probability distribution is. The expected cash flow in a year should be the probability-weighted estimate of the cash flows under all scenarios for the firm ranging from the best to the worst case. Each of these discrete payout scenarios could then be assigned a probability and the probability-weighted average payout could be discounted based on market participant assumptions.

The first point to adjust for risk is necessary because not all businesses projects or investment opportunities have the same level of risk. The probability-adjusted APV analysis is the same as before except that the rate used discount free cash flows is the VCs hurdle rate. In more realistic situations there could be many possible outcomes.

The forecast has to. Technique that incorporates a probability-weighted approach applied to discounted future cash flows of the underlying IA and Eligible Notes while considering. The first step in the DCF model process is to build a forecast of the three financial statements based on assumptions about how the business will perform in the future.

But accountants have grown used to the most-likely meaning for best estimate. Some maintain that expected cash flow techniques are inappropriate for measuring a single item or an item with a limited number of possible outcomes. The declines noted in actual revenues occurred during the second half of 2015 during which time Eagle Publishing did not produce a bestseller and renewals of financial publications declined.

Cash flow formula is to reduce the cash flow forecasts as in the first specification and to also increase the discount rate beyond the cost of capital by adding the chance that the downside will occur. We can then create an initial investment decision by comparing the return on investment to the companys target which is a model input. They are best used to simplify and rule out certain decisions.

Some practitioners use a method that simultaneously adjusts both the cash flow and discount rates. They offer an example of an asset or liability with two possible outcomes. While the former is the more precise measure it is seldom used simply because it requires far more.

So if the CAPM return on equity is 15 and the probability of success is 30 the VC hurdle rate is 50. The adjustments to the discounted cash flow formula reduce the estimated value of. We then adjust our outputs to use these risk-weighted cash flows.

A 15 probability of collecting zero a 25 probability of collecting 40000 and a 60 probability of collecting 60000. By requiring the probability-weighted expected-cash-flow approach the results will not likely. Transparency through the Income approach.

CU780 CU75 CU480 CU225 In this simple illustration the expected cash flows CU780 represent the probability-weighted average of the three possible outcomes. The expected cash flows that we use to value risky assets can be estimated in one or two ways. Net Cash Flows should be Probability-Weighted Expected Values But what measure of economic benefit matches the pricing of.

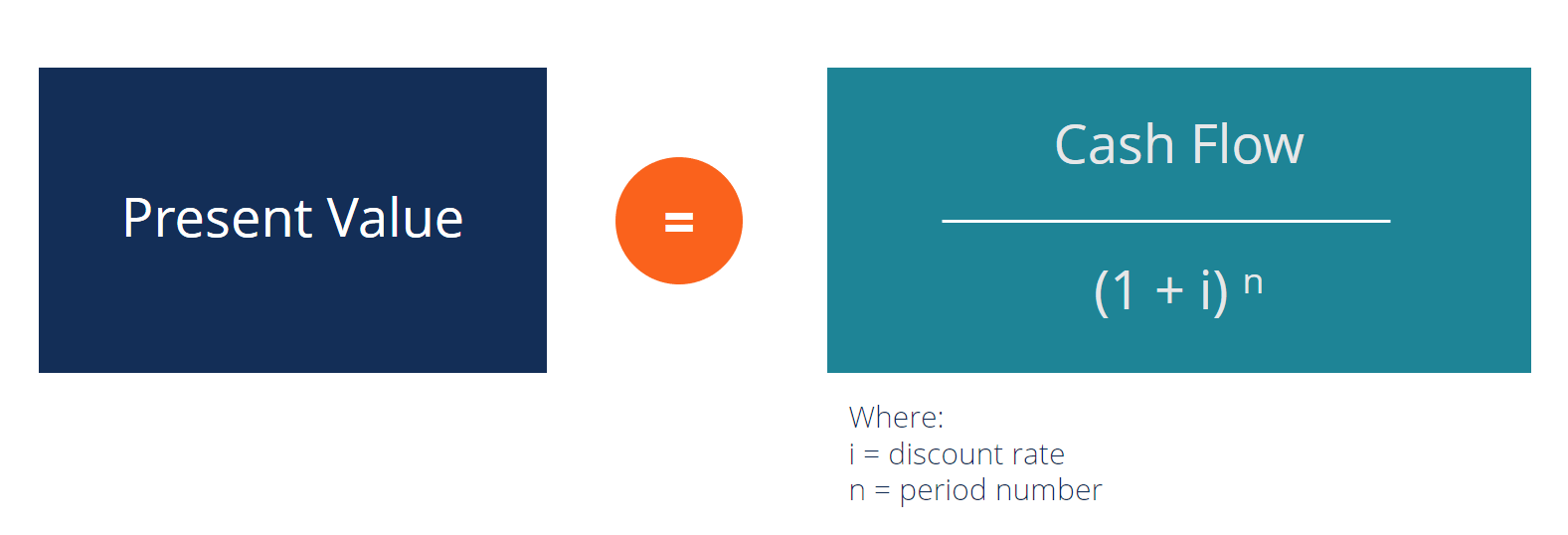

Probability weighted discounted cash flow method. The cash flows in net present value analysis are discounted for two main reasons 1 to adjust for the risk of an investment opportunity and 2 to account for the time value of money TVM. We calculate risk-weighted cash flows by multiplying each of the annual cash flows in our model by the success probability.

As illustrated in paragraph 46 of CON 7 the risk free rate used to discount the estimated future cash flows varies based on the time horizon of. They can represent a probability-weighted average of cash flows under all possible scenarios or they can be the cash flows under the most likely scenario. The discounted cash flow DCF method a widely used method under the Income Approach has always served an important role in increasing the transparency of a valuation analysis.

That is the EDF metric combines data from a firms balance sheet with the firms stock price which is also the markets expectation of discounted future profits with every possible profit path weighted by the probability of that path occurring. Probability-weighted present value for each scenario 4 Taking the sum of the present value of each probability weighted scenario.

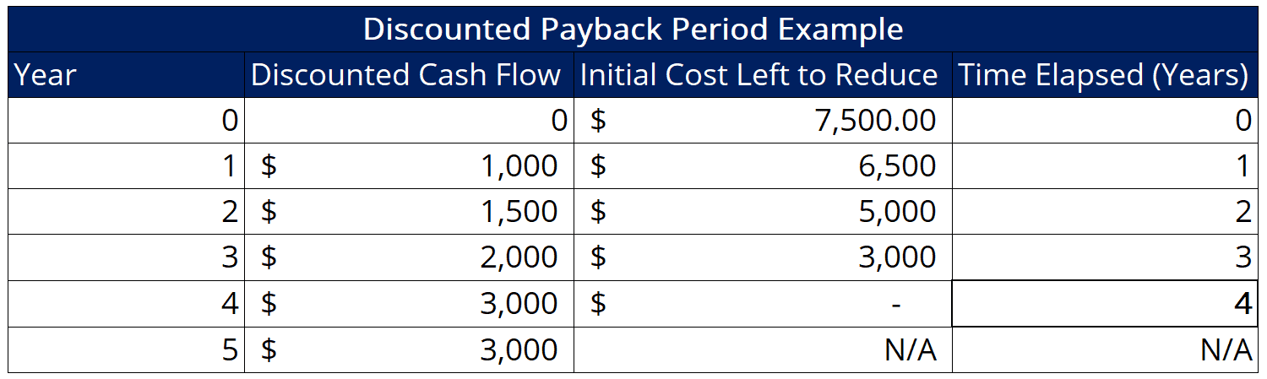

Discounted Payback Period Definition Formula And Example

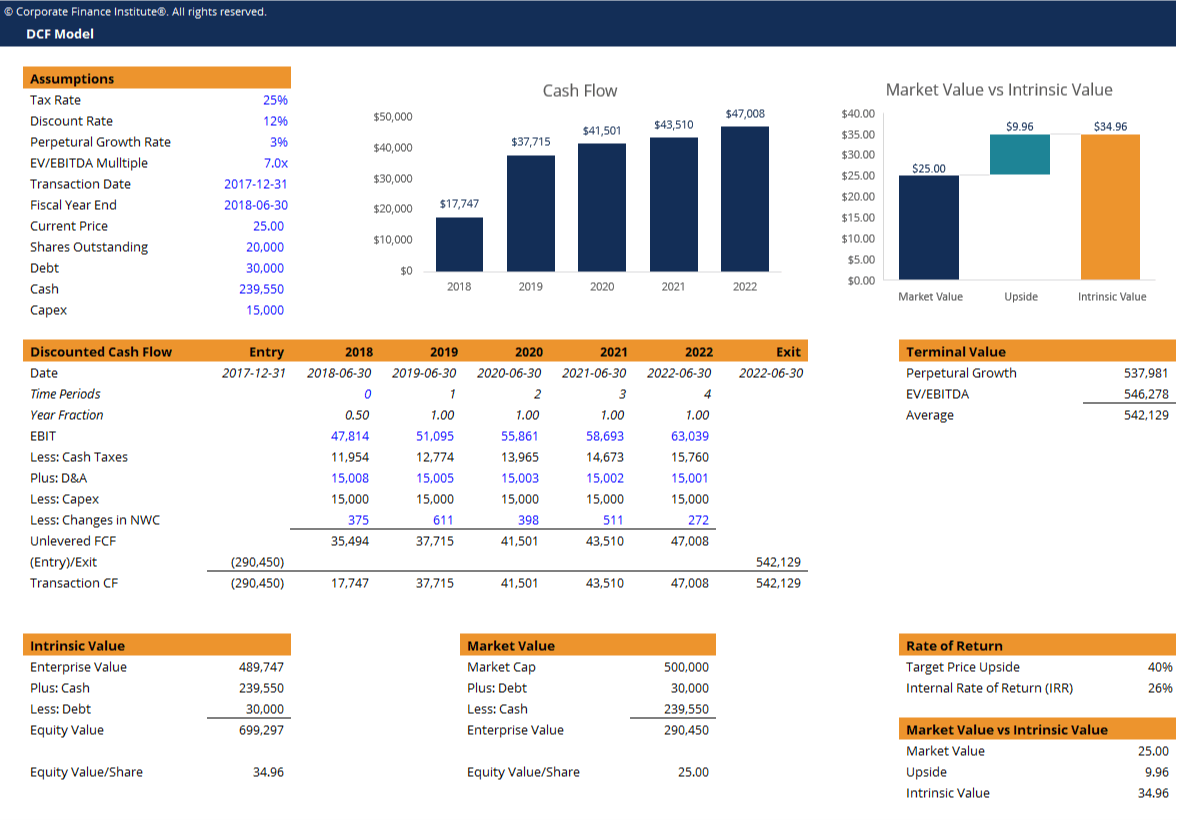

Discounted Cash Flow Analysis Tutorial Examples

How To Calculate Npv Using Xnpv Function In Excel

How To Calculate Discounted Cash Flow For Your Small Business

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Npv Formula Learn How Net Present Value Really Works Examples

What Is Discounted Cash Flow What Should Magento 2 Merchant Know

Discounted Cash Flow Modeling Vose Software

How To Calculate Discounted Cash Flow For Your Small Business

Discounted Cash Flow Analysis Tutorial Examples

Npv Formula Learn How Net Present Value Really Works Examples

Npv Formula Learn How Net Present Value Really Works Examples

Discounted Cash Flow Analysis Tutorial Examples

Using A Dcf Model To Value Biotech Stocks The Motley Fool

Discounted Cash Flow Analysis Tutorial Examples

Discounted Cash Flow Analysis Tutorial Examples

Npv Formula Learn How Net Present Value Really Works Examples

Discounted Cash Flow Analysis Tutorial Examples

Discounted Cash Flow Analysis Tutorial Examples