Important! How To Calculate Effective Interest Rate On Discounted Loan

The calculation of effective interest rate includes. Ad A Flexible Personal Loan Alternative.

How To Calculate Effective Interest Rate 8 Steps With Pictures

No Monthly or Annual Fees.

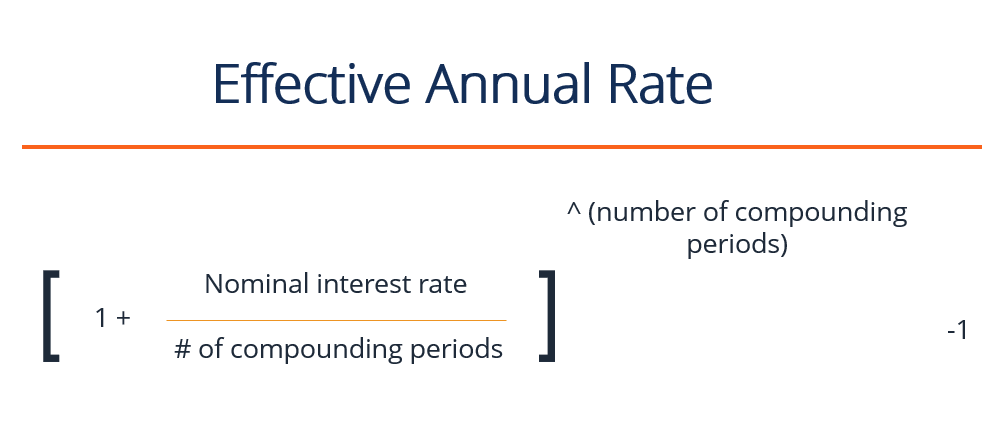

How to calculate effective interest rate on discounted loan. Locate the stated interest rate in the loan documents. R 1 inn -1. Ad Find out how much you can borrow view top loans on Mozo.

Figure out the effective interest rate on a loan by determining the nominal annual. All fees and points paid or received between parties to the contract that are an integral part of the effective interest rate IFRS 9B541 and. The interest rate your lender gives you isnt the true cost of your mortgage.

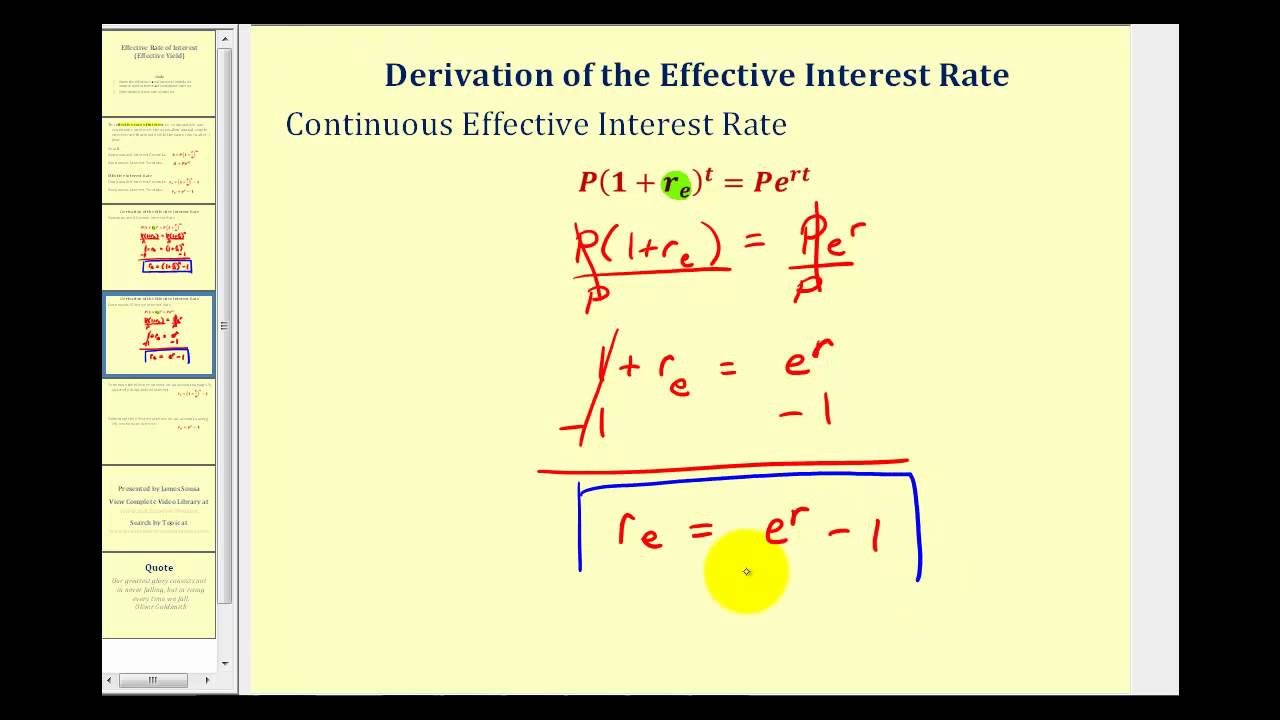

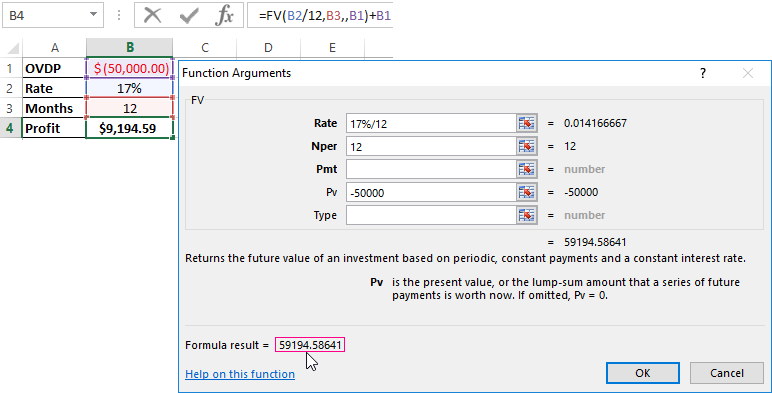

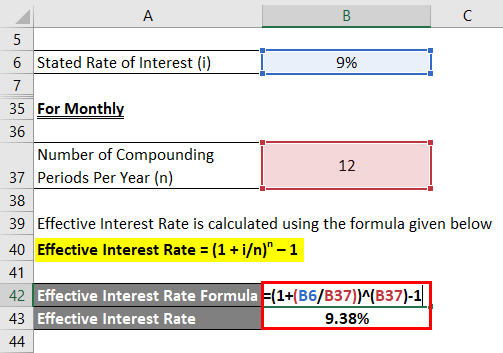

Monthly effective rate will be equal to 16968. Paragraphs IFRS 9B542-3 give examples of fees that are and are not an integral part of the effective interest rate. I 1 r m m 1.

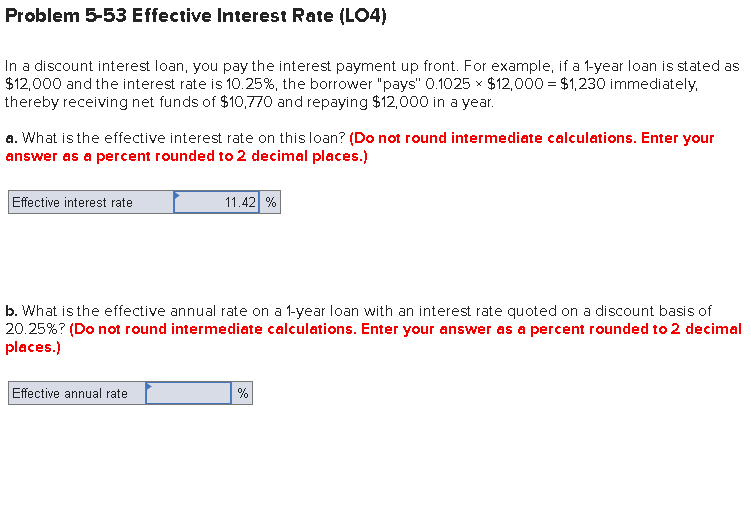

Mathematically it is roughly calculated as follows. However the new law requires banks to specify in the loan agreement to the effective annual interest rate. These include administrative fees which are added to the interest charged on your loan increasing the amount you have to pay back in total.

The nominal percent is 16968 12 is 203616. Review Australias Leading Lenders to find home loan rates save today. Example with 10000 and 2 10 days net 30 days.

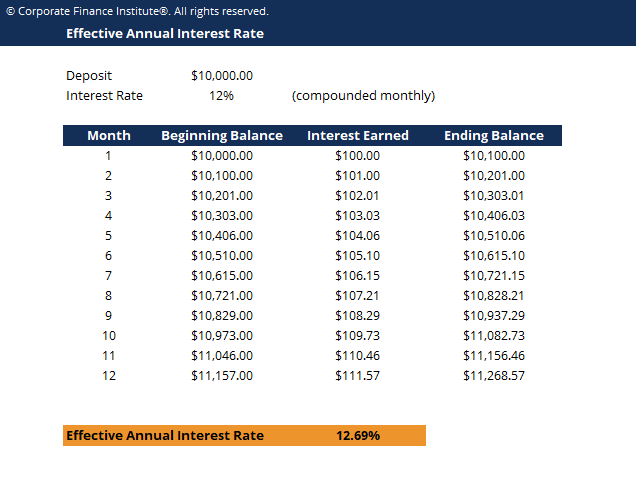

Ad Take Control Of Your Finance With Flexible Loan Packages From 500 To 10000. Even though the bank offered a 12 stated interest rate your money grew by 12683 due to monthly compounding. Ad Meet with a broker from the comfort of your own home.

Comparison Rates From 199. Compare loans side-by-side from 80 lenders. Without accessing your credit file.

The monthly fees increased till 22 37. Open a mortgage calculator like this one from Bankrate. Looking to decrease your loan repayments.

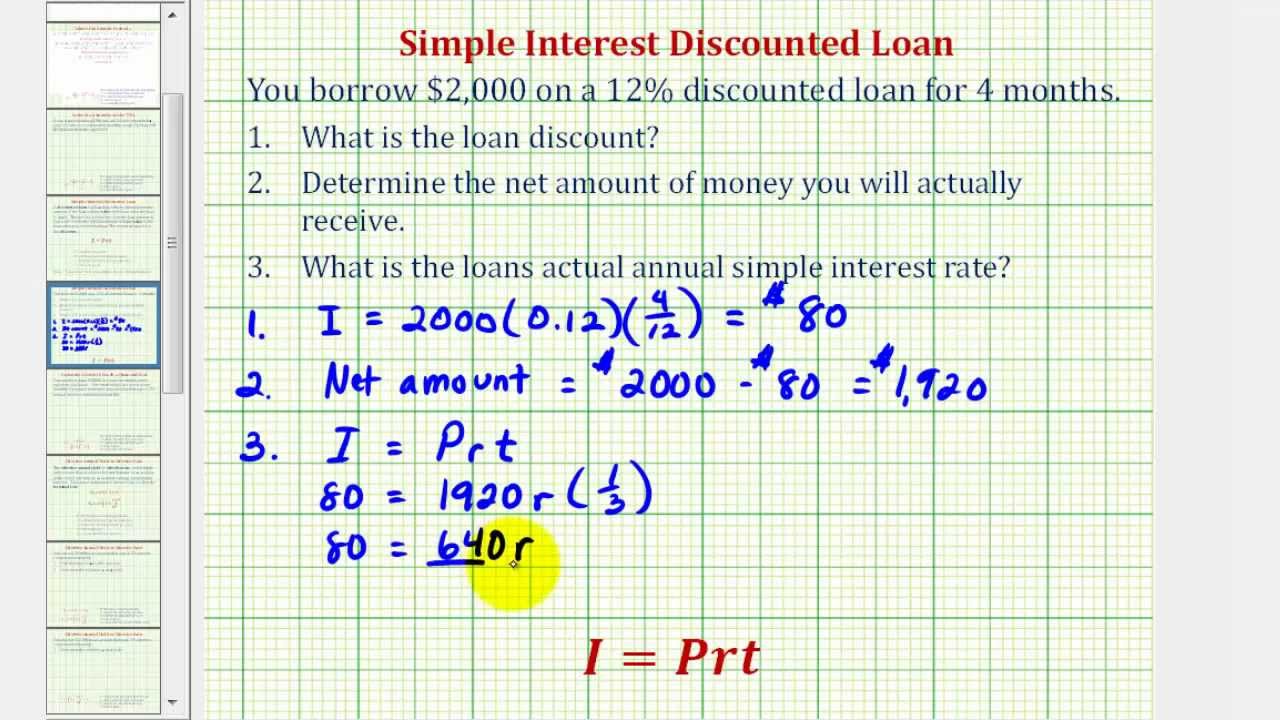

This higher interest rate is the one you have to pay ie it is your effective interest rate. R 1 inn-1. Effective rate on a discounted loan Interest X Days in the Year 360Days Loan is Outstanding Principal - Interest Effective rate on a discounted loan 60 X 3603601000 - 60 638 As you can see the effective rate of interest is higher on.

10000 - 2 discount 9800. Ad Find out how much you can borrow view top loans on Mozo. I 1 00724 4 4 1.

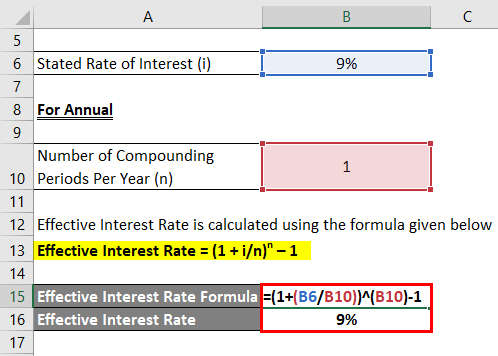

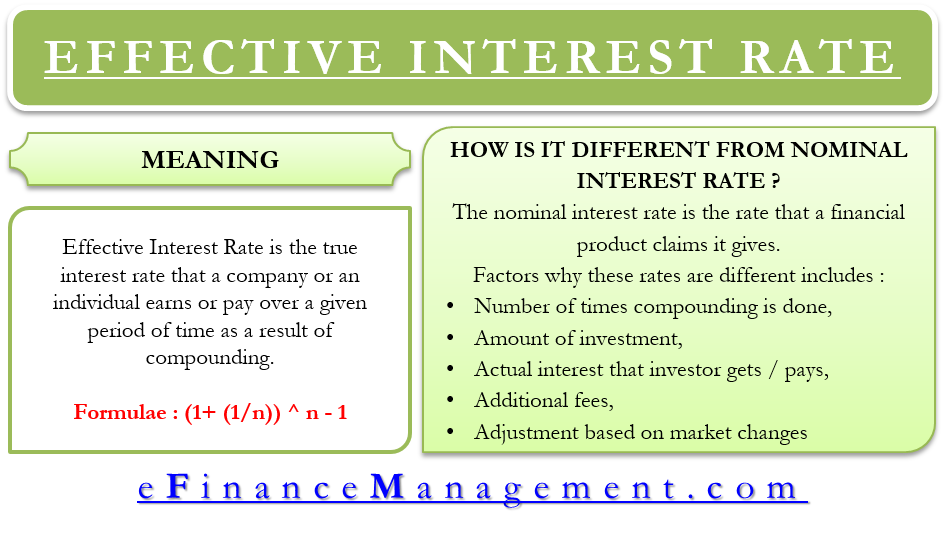

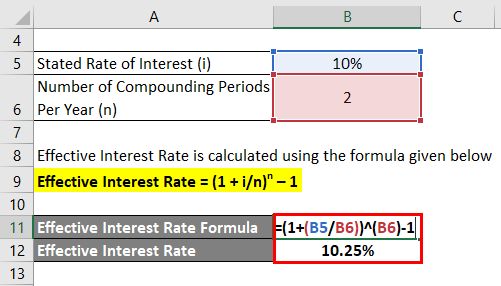

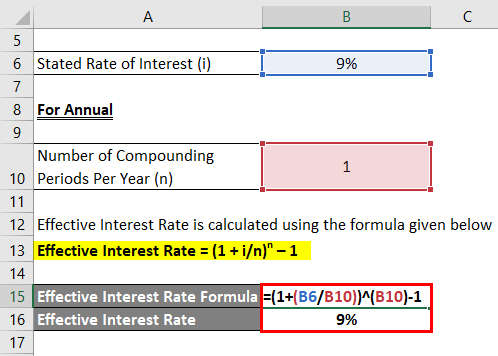

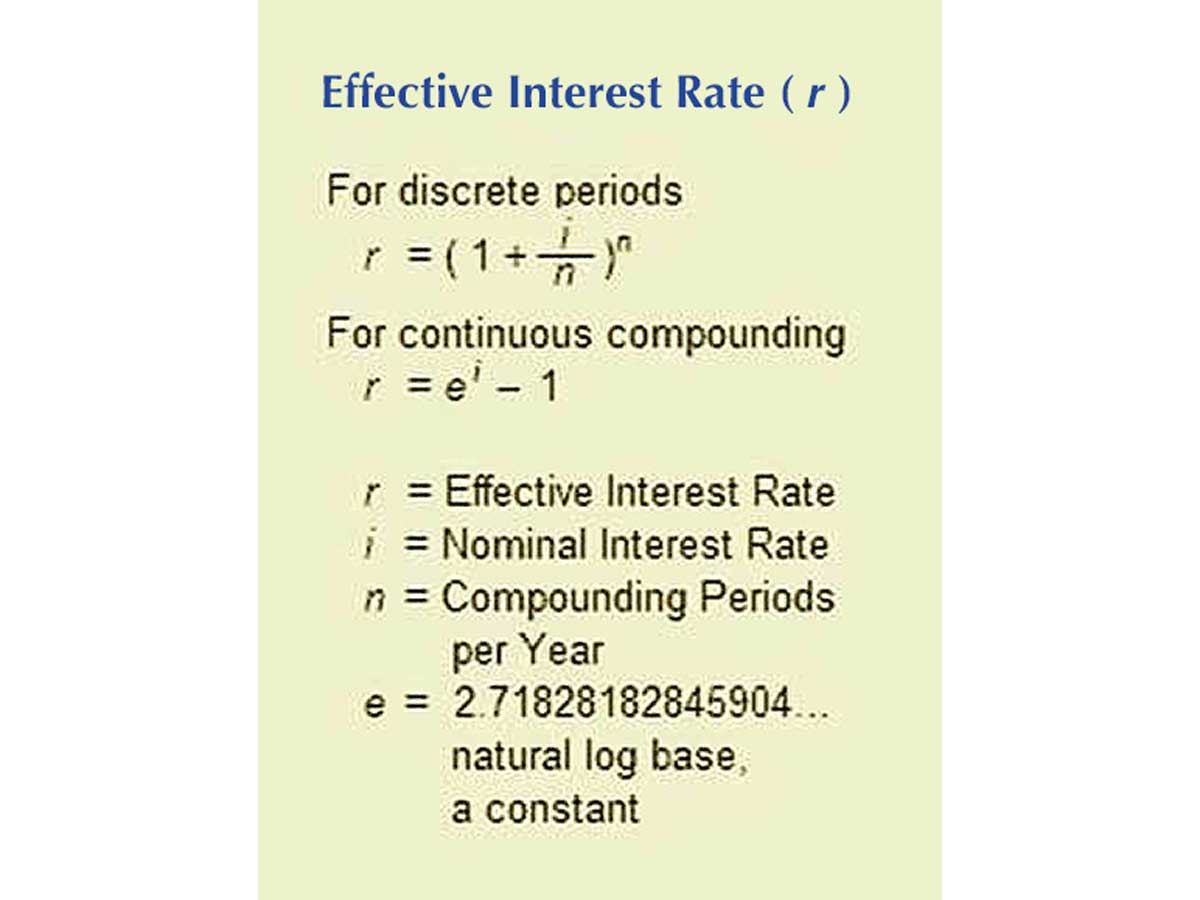

Find a great rate more easily with expert advice from application to settlement. N number of compounding periods per year. Enter the compounding period and stated interest rate into the effective interest rate formula which is.

Ad Compare multiple loan options. At 718 compounded 52 times per year the effective annual rate calculated is. Get better savings returns with a fixed rate bond.

Comparison Rates From 199. I 1 00718 52 52 1. For example a loan document contains a stated interest rate of 10 and mandates quarterly compounding.

Reverts to Std Var Rate. I nominal annual interest rate. Looking to decrease your loan repayments.

Divide your interest rate by the number of payments youll make in the year interest rates are expressed annually. In the example seen below the sales term 2 10 days net 30 days gives an annualized rate of 367 and an effective annual rate of 439 if the interests are capitalized every 20 days throughout the whole year. Estab Fee TCs Apply.

So for example if youre making monthly payments divide by 12. Multiplying by 100 to convert to a percentage and rounding to 3 decimal places I 7439. Estab Fee TCs Apply.

The change in percentage from the beginning balance 10000 to the ending balance 11268 is 11268 1000010000 12683 or 12683 which is the effective annual interest rate. Because you are now paying back a higher amount your interest rate on your loan becomes higher. Multiply it by the balance of your loan which for the first payment will be your whole principal amount.

Ad With interest rates at a historic low get a better return with a fixed term bond. Add this amount to. For 3 Yrs on Balance Transfers.

R effective interest rate. Ad Quickly Compare Low Refinance Investment Rates on the market. Compare loans side-by-side from 80 lenders.

R The effective interest rate i The stated interest rate n The number of compounding periods per year. More choice with 60 lenders. The effective annual rate is.

Add up your discount points origination fees and other up-front costs like mortgage insurance premiums Note. But in the loan contract will continue to be the figure of 18.

How To Calculate Effective Interest Rate On Bonds Using Excel

Ex Simple Interest Discounted Loan Youtube

Effective And Nominal Interest Rates Youtube

How To Calculate Effective Interest Rate On Bonds Using Excel

Effective Interest Rate Formula Calculator With Excel Template

Solved Problem 5 53 Effective Interest Rate Lo4 In A Chegg Com

How To Calculate Effective Interest Rate 8 Steps With Pictures

:max_bytes(150000):strip_icc()/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)

Stated Annual Interest Rate Definition

Effective Interest Rate Meaning Formula Importance And More

Calculation Of The Effective Interest Rate On Loan In Excel

Effective Annual Rate Definition Formula What You Need To Know

Effective Interest Rate Formula Calculator With Excel Template

Effective And Nominal Rate Of Discount Indiafreenotes

Effective Interest Rate Formula Calculator With Excel Template

Effective Annual Rate Formula Calculations Video Lesson Transcript Study Com

Effective Interest Rate Formula Calculator With Excel Template

How To Calculate Interest Compounding For Exponential Growth

Effective Annual Rate Ear How To Calculate Effective Interest Rate

How To Calculate Effective Interest Rate 8 Steps With Pictures